Table of Contents

Exploring what it means to build Bitcoin-native businesses, we discussed:

What is a Bitcoin-Native Business (BNB)?

3 core principles of Bitcoin-native businesses:

The Problems Facing BNBs in 2025:

2. Understanding Root Problems for Users

Solving Bitcoin Business Problems

2. Identifying Urgent Problems to Solve

From Bitcoin Walk to Bitcoin Works: My Own BNB story

Edinburgh: A New Hub for Bitcoin Innovation

The UK’s First Dedicated Bitcoin-Native Workspace

Opening in January 2025 — explore the space and join the waitlist.

In my 15+ years working with startups, I’ve learned a lot about why new businesses fail.

Mainly, it’s because they never find product-market fit—a result of building a product or service their target audience doesn’t need enough, or doesn’t need enough 'right now'.

For new businesses, not finding PMF early is a death knell — unless they’re building a new product or add-on for an existing loyal audience, or as Kevin Kelly would say: their 1,000 true fans.

Of course these businesses are not guaranteed success. Their products and services still have to be in demand and useful ‘right now’ for them to succeed. But Bitcoin-native businesses have an added advantage: they launch directly into a prebuilt loyal audience of many 1,000s of true ₿itcoin fans.

To capitalize on this advantage, Bitcoin-native business founders must:

- Deeply understand their audience and the problems they are trying to solve.

- Reach investors both inside and outside the Bitcoin space.

- Do their utmost to leverage the existing network effects already present in the Bitcoin ecosystem

In this blog, we’ll look into Bitcoin-native business challenges in detail, and I’ll offer my thoughts on possible fixes.

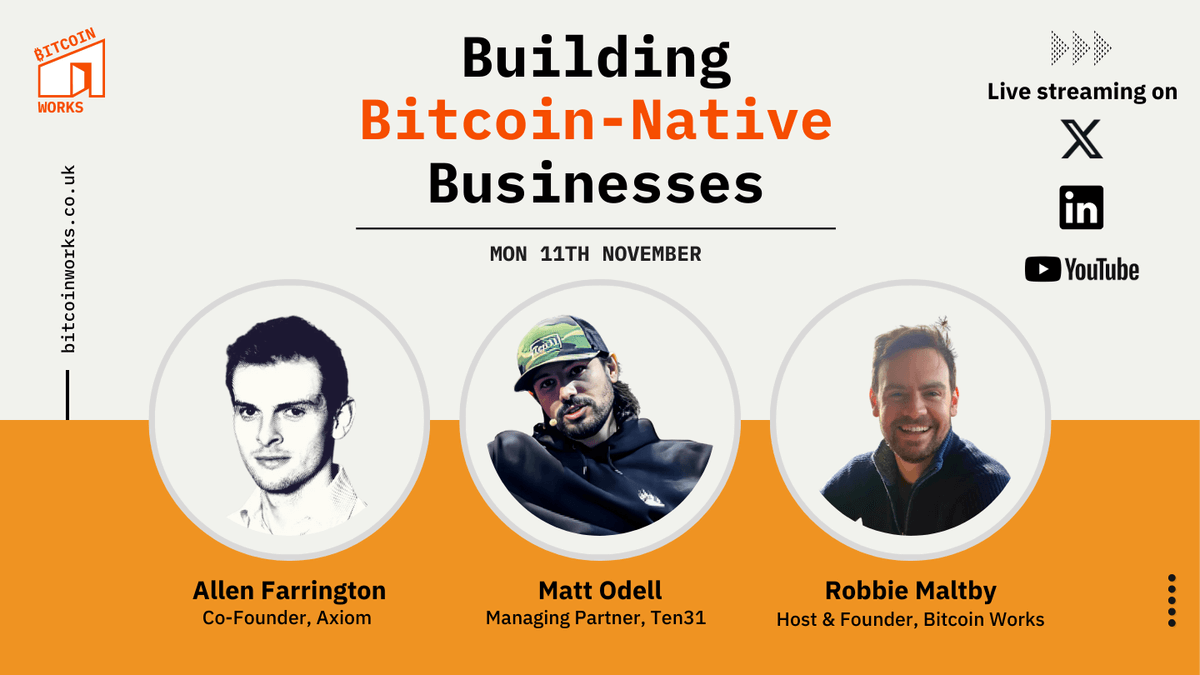

Before that, watch the recap!

Exploring what it means to build Bitcoin-native businesses, we discussed:

- Bitcoin's Evolving Role in Finance and Commerce

- Rise of Bitcoin-Native Ecosystems

- Community and Open-Source Collaboration

What is a Bitcoin-Native Business (BNB)?

A company founded with the first principle that bitcoin is the global monetary asset of the future and internet-native digital cash. The company builds a product the success of which is mutually aligned with the success of Bitcoin.

This definition of ‘bitcoin-native’ by Trammell Venture Partners is a perfect baseline to begin our expanded thesis:

3 core principles of Bitcoin-native businesses:

- Create products and services that reinforce the Bitcoin economy.

- Position Bitcoin as a practical, global asset beyond mere speculation.

- Encourage more people (including ‘normies’) to participate in the Bitcoin ecosystem.

In essence, BNBs are more than just businesses that accept Bitcoin and benefit from asset appreciation—they’re built to grow alongside the Bitcoin network, amplifying its adoption and real-world impact.

The Problems Facing BNBs in 2025:

Bitcoin is a once-in-a-lifetime technology. Absolute scarcity is a completely new concept in financial terms, and it’s not surprising that businesses are taking time to react to this innovation.

There is a great opportunity for Bitcoin-native businesses, but as early adopters, they face challenges that companies on a well-trodden path do not.

1. Lack of Adoption

With comparatively few businesses accepting Bitcoin payments, the public struggles to see an immediate use case. In its current phase, Bitcoin is mostly used as a long-term savings technology (as protection from inflation). Yet, this amplifies the ‘cold-start problem’, where fewer customers lead to fewer merchants, and vice versa.

Every ‘Bitcoin accepted here’ sign is a signal to the public that it is sound and workable money. Coca-Cola spends millions every year on shop signs, cafe furniture, and store displays just to get their logo out there on the street. Visibility is the key. No single entity owns Bitcoin’s marketing budget — in fact, it doesn’t have one. It’s up to BNBs and early adopters to make greater adoption possible through increased visibility.

As of October 2024, world Bitcoin adoption stands at around 6%, the same as in 1999 for Internet use. We are early!

This said, it’s certainly a major challenge for BNBs to gain traction if only 6% of the planet has been onboarded to their way of doing business.

2. Understanding Root Problems for Users

Even with a base of willing enthusiasts, BNBs often struggle to scale their solutions, only to realise the problem they’re solving isn’t as pressing as they first thought.

I recently conducted a global survey among bitcoin users which highlighted some real-world problems not being adequately addressed by Bitcoin-native businesses.

Not being able to find merchants that accept Bitcoin was the highest rated problem for all users combined in the 'Onboarding and User Experience' category of the survey. This is great validation for a company like Musqet, who are leading the charge in the U.K to integrate Bitcoin into existing point-of-sales systems, making paying in Bitcoin as seamless as with regular payments methods—while reducing overall transaction costs.

Interestingly, when you segment the results by users who only invest in Bitcoin (we'll call them Bitcoin Maxis for the time being) finding unbiased news and reliable peer groups become far more pressing problems.

Spoiler: it’s these users Bitcoin Works is being built for.

Unless you perform this kind of analysis, which most startups don’t, you’ll never truly understand why people do (or don’t do) the things you expect from them.

As I said previously, Bitcoin-native business have the advantages of the pre-built audience, but unless they know how and why they are serving them today, they will often fall short.

--

Note: You can view the full results of the survey by taking part, anonymously. You'll be redirected to the results on completion.

3. ‘Us vs. Them’

Continuing on the ‘Bitcoin Maxi’ theme from above, Bitcoin has been described by many as a cult. Early adopters are knowledgeable, uncompromising, and passionate. Many OG bitcoiners and maxis see the world as divided into two — bitcoiners and ‘normies’.

This attitude is understandable. The pioneers have taken huge risks, invested hundreds of hours of learning and work, and have faced ridicule for their beliefs. But taking a hardline stance against the 94% of non-adopters is unlikely to help your business.

Of course, many BNB users and customers come from the core of Bitcoin converts. But messaging, communications, and marketing need to be balanced to make new prospects and customers feel welcome. A key challenge for Bitcoin-native businesses is finding the right voice to speak to both sides and gain traction.

4. Fractured Digital Space

Content marketing is a challenge for startups. It can be hard for new businesses to maintain a presence across so many social media platforms. Consumers have gotten used to high-quality brand content and sites with wide-ranging useful blogs, and new companies struggle to make themselves heard.

Further, Bitcoin-friendly platforms like X (formerly Twitter) have fractured into many directions — Nostr, Bluesky Social, Mastodon. It’s not easy to reach a large number of global users with one message in one place without huge ad spend.

BNBs must focus their resources on building communities of potential users who are invested in their success.

Physical vs Digital space:

Recent global crises, combined with advances in communication technology, have sparked a digital revolution and raised questions about the need for both physical and digital workspaces. While each has its advantages, physical proximity brings unique benefits to the well-being of businesses and their people.

Top 6 Benefits of Sharing a Workspace:

— Bitcoin Works (@BitcoinWorks__) October 30, 2024

𝟏. 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞𝐝 𝐩𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐯𝐢𝐭𝐲 (𝐬𝐞𝐫𝐢𝐨𝐮𝐬𝐥𝐲)

With other people around, you’ll feel the accountability and can keep your head down.

𝟐. 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐢𝐧𝐠 𝐨𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬

We’re so much more open to… pic.twitter.com/UKE2IgEqJz

This is especially true for Bitcoin-native businesses, which mostly offer digital services for a network of digital internet money. And as people with the right skills are often scattered around the globe, these startups often begin life as remote operations.

But the importance of physical proximity and gatherings can be seen in the explosion in Bitcoin conferences. 2024 Bitcoin-only conferences like Bitcoin Nashville, BTC Prague, and Lugano's Plan ₿ were attended by tens of thousands of enthusiasts and entrepreneurs. There is nothing like swapping ideas and forging new partnerships in person.

Proof-of-work is what sets Bitcoin apart from other digital currencies—it requires real-world energy to secure the network, grounding this digital asset in the physical world.

— Bitcoin Works (@BitcoinWorks__) October 26, 2024

Unveiled at the @LuganoPlanB Forum in Lugano this weekend, a new statue of Satoshi Nakamoto, Bitcoin’s… pic.twitter.com/vLevs7KNHX

For employees, entrepreneurs, and businesses to stay healthy in 2025, they must take steps towards maintaining a physical presence as well as a digital one.

Solving Bitcoin Business Problems

1. Growing visibility

Visibility in the real world is crucial for the public to grasp the inevitability of systemic Bitcoin adoption.

Bitcoin-only exchange Relai understands this and is sponsoring an ice hockey team in Switzerland, bringing their logo (and the Bitcoin message) to a wider audience.

Another recent example from the Bitcoin ecosystem is Eric Yakes and his VC firm Epoch taking an office at Denver's #bitcoin citadel, The Space.

It’s official@epochvc_ is open at @SpaceDenver with beautiful branding and signage

— Eric Yakes (@ericyakes) November 6, 2024

Completely unburdened by what has been

If you’re a building a company tied to #bitcoin adoption we want to talk to you pic.twitter.com/BBmuSV9pZb

If your business is just getting started, taking it to the physical world is necessary for real forward motion. This can be at meetups, conferences, through merchandise, or through setting up an office. Physical offices are like a billboard for your brand as well as a dedicated space for partners and customers to see you operating in the real world.

2. Identifying Urgent Problems to Solve

Businesses in the bitcoin space need the know-how of experienced investors, consultants, and market researchers in order to identify the root of the problems in the bitcoin ecosystem. With access to powerful customer discovery tools and frameworks, plus the right brains to use them, BNBs can flex and pivot with changing market needs, just as all startups must do.

Much of this research can be quantitative, data collected from stack ranking surveys like the ones linked previously, but in order to gather the initial insights, and for continuous feedback and improvement, qualitative feedback is crucial. Interviews, both in-person and remote, meetups, live in-person tests, will help BNBs see the immediate problem in their approach. What is the hurdle they need to clear to make their product or service invaluable? Having a space for tests, pilot programs and to plan feedback sessions allows companies to build qualitative feedback so they can adjust accordingly.

Finally, in order to conduct the right research and apply new strategies to hone their approach, BNBs need access to expert advice. This comes in the form of seasoned investors, founders, and marketers in the space.

When businesses gain a mutual benefit from helping each other in a local Bitcoin ecosystem, it creates organic network effects that become amplified as the community grows. For example, from the very beginning, founding members at Bitcoin Works receive mentoring support from myself. In return, as the local ecosystem grows, so do investment opportunities for tenants like Axiom, job opportunities for Bitcoin enthusiasts, and more ideas and opportunities for everyone—including me—to contribute to and benefit from.

3. Building a Community

At some point, we were all outside the world of Bitcoin, looking in. Trust is built through key relationships, community, and in-person gatherings.

Rather than sticking to the ‘us vs. them’ mentality, BNBs must curate and participate in events that extend a hand to ‘outsiders’. Regular meetings, public events, and dedicated spaces are necessary to create positive experiences and educate the 94% of non-users.

Initiatives like Bitcoin Walk are wonderful ways to meet and learn in the open, hold conversations, and welcome new and existing bitcoiners. That’s why at Bitcoin Works, we partner with this growing organisation. In the early stages of business, every customer relationship counts, and growing a community is your fast track to winning over new converts.

4/20 SAT Bitcoin #Halving Walk - absolutely epic ❤️🔥🙌🏻

— BitcoinWalk ⚡️ (@BitcoinWalkOrg) April 20, 2024

New people, more conversations, more orange pilling one step at a time 🤓#ProofOfWalk pic.twitter.com/diSbJYdgQ9

This was my first ever BitcoinWalk!

4. Escaping the Digital Trap

Keeping a strong foothold online is a real challenge for startups. Platforms rise and fall, spaces fracture, and the rules of the game are disrupted. Content is forever changing, but more than ever, consumers are demanding trustworthy faces and real-world spaces in order to pay attention to novel ideas.

Presenting a professional, physical space for your brand is also essential in today’s world of content marketing. Messy bedroom podcasting desks and noisy cafe environments don’t present the image that businesses need to attract investors and users.

From Bitcoin Walk to Bitcoin Works: My Own BNB story

Humans need stories. Narratives help us make sense of the world, yet we rarely question the underlying systems that shape society—we simply accept them.

After attending a Bitcoin Walk event and reading The Bitcoin Standard in early 2024, I started to ask deeper questions about how finance drives the prevailing ideas of the world. The right ideas don’t always get noticed as our financial system has corrupted what we pay attention to. Bitcoin fixes this.

As Nietzsche once said, “All truly great thoughts are conceived while walking.” 🚶♂️✨

— Robbie Maltby (@robbie_maltby) October 23, 2024

At the beginning of the year, I took a walk that changed everything. I met Jacob Piotrowski—better known as Endo Rivers—the founder of @BitcoinWalkOrg. That encounter set off a chain reaction… pic.twitter.com/BxQhplHWlw

Almost overnight, I launched Bitcoin Studios and went to events in Prague and Riga to meet founders and investors with the same vision. A chance meeting while waiting for a taxi in Prague led me to meet a fellow Scot, Allen Farrington, who suggested that other Bitcoin businesses (like his own, Axiom) would benefit from sharing the same workspace.

Things have moved very quickly (as they always do in Bitcoin). I launched a Meetup group to invite local Bitcoiners to gather every Thursday at Levels Cafe and Lounge—where I'm sitting right now catching my node up on a few (transaction heavy!) blocks after the election result last night.

This has been my research launch pad and focus group for Bitcoin Works, the first dedicated Bitcoin-native workspace in the UK.

If you'd like to join, pop down to Levels Cafe any Thursday or join the Telegram group for updates.

Edinburgh: A New Hub for Bitcoin Innovation

New business hubs do not emerge from nowhere. They take time to develop and are often based on transition rather than something entirely new.

Lower sales and gas taxes in Texas attracted four of the “big five” tech companies—Apple, Google, Facebook, and Amazon in 2019—and many large and mid-sized tech companies have followed in their footsteps. With a wave of tech entrepreneurs moving in, Austin has now earned its title of “Silicon Hills.”

Singapore started its transition to ‘startup incubator’ by investing in world-class infrastructure. Singapore is home to one of the world’s busiest airports and has direct flights to major cities across Asia, Europe, and the Americas. The city-state’s high-speed digital infrastructure and widespread 5G are crucial for startups in the fintech, AI, and IoT sectors.

Similarly, Edinburgh is a business city in transition. The Royal Bank of Scotland (RBS) was founded in 1727 by royal charter, and the city now has over 30,000 people employed in the banking and insurance industries. Fintech startups are developing to support the industry’s 21st-century growth. And in 2025, the city can begin to host businesses and entrepreneurs building towards a new financial paradigm to become the Bitcoin capital of the north.

Bitcoin Works: Edinburgh

- Vibrant Waterside Working

- Over 30 coffee shops, bars, and restaurants, right on your doorstep.

- Buzzing Port District in the Gateway to Edinburgh

- Farmers markets, and award-winning restaurants, all within a few mins walk.

- Direct tram links to the city centre (24 mins) and Edinburgh airport (56 mins)

Scotland’s capital is well set to become a BNB hub, perhaps even gaining the entrepreneurial clout of Austin or Singapore.

A recent example from Cartwright shows how quickly Bitcoin adoption can take hold in industries widely perceived to move at a snail's pace. Home to some of the UK's largest pension providers, Scotland’s capital is well set to become a BNB hub for exactly these kinds of forward-thinking movements to take root.

The UK’s First Dedicated Bitcoin-Native Workspace

Bitcoin Works is designed with Bitcoiners in mind. It is everything you would expect from a workspace, plus a ₿it more. Here’s how Bitcoin Works supports the success of BNBs:

Opportunities for collaboration:

Coworking in a Bitcoin-focused space connects BNBs and creates valuable opportunities to find partners, customers, and employees.

Flexibility and Reduced Overheads:

Bitcoin Works reduces the operational burden typical of traditional office setups. Instead of getting stuck with long-term leases, equipment costs, and contract logistics, it’s possible to focus on what matters to your business.

Meeting In Person:

Wherever a company is based, people are at the heart of the Bitcoin ecosystem. Workshops, focus groups, events, Q&As, podcast recordings, and bigger on-site community events at Bitcoin Works forges relations and opens otherwise impossible opportunities.

Real-World Visibility:

Bitcoin Works brings Bitcoin out of the digital realm and into everyday Edinburgh life. The map of BTC businesses in the Scottish capital is growing. Every logo, every event, and every ‘Bitcoin Worker’ act as a billboard for the project and for your bitcoin-native business.

Strategic Location:

These Edinburgh-based private offices help BNBs grow their network and get a foothold in the Bitcoin capital of the north. The city is home to innovation and has both the talent and appetite to support the growth of the Bitcoin ecosystem.

Coworking and events space tailored for Bitcoin businesses and enthusiasts:

- Spacious 4-person offices

- Bright and buzzy coworking space

- Superfast fibre optic WiFi

- Tiered boardroom and events space access

- Tiered podcasting room access

- Kitchen and shared eating space

Opening in January 2025 — explore the space and join the waitlist.

Looking Forward: The Future for Bitcoin-Native Businesses

Although we are still early in the journey to widescale Bitcoin adoption, the support ecosystem and levels of innovation are driving us swiftly forward. 2025 will likely be huge for Bitcoin-native businesses with more adoption, more partnerships, successful events, and widespread interest.

Certainly, there are still hurdles for BNBs to clear, and the path to financial integrity is never guaranteed. We must keep building our community and working towards positive change.

I hope that you and your business will be part of that change.

***

Join the waitlist for Bitcoin Works — launching soon.

Be part of the founding community and lock in your membership discount for life.

Join founding partners — Axiom, Bitcoin Walk, Northbound Digital, and Bitcoin Studios.